Now is the time to prepare details of your taxable benefits

The last tax year has not long ended, but now is the time to think about how you report taxable benefits provided to your employees.

On the horizon there is the all important P11D deadline looming, which may require some employers to report taxable benefits provided in the last year to HM Revenue & Customs (HMRC).

What is a P11D form?

The P11D (for income tax) and P11D(b) for Class 1A National Insurance Contributions) are used to report benefits provided to employees and expense payments by employers that are not included in the payroll process.

Workplace childcare vouchers – get the best out this scheme during COVID-19

As many employees began working from home during the height of the coronavirus pandemic, they used less paid childcare, as many before school clubs and nurseries were closed.

Plea for action to prevent “explosion” of fraud phone calls

Fraudsters are costing the UK economy up to £190 billion each year, research reveals.

Five ways cloud accounting could boost your business

Cloud accounting is simple, fast, and efficient. So why are so many businesses refusing to make the switch?

In this blog, we’re going to explore just five ways cloud accounting could boost your business and help you leave competitors behind.

Real time data

Are you looking to hire under the Kickstart Scheme?

With many younger people struggling to find employment due to the pandemic, the Government launched the Kickstart scheme to incentivise employers to take them on.

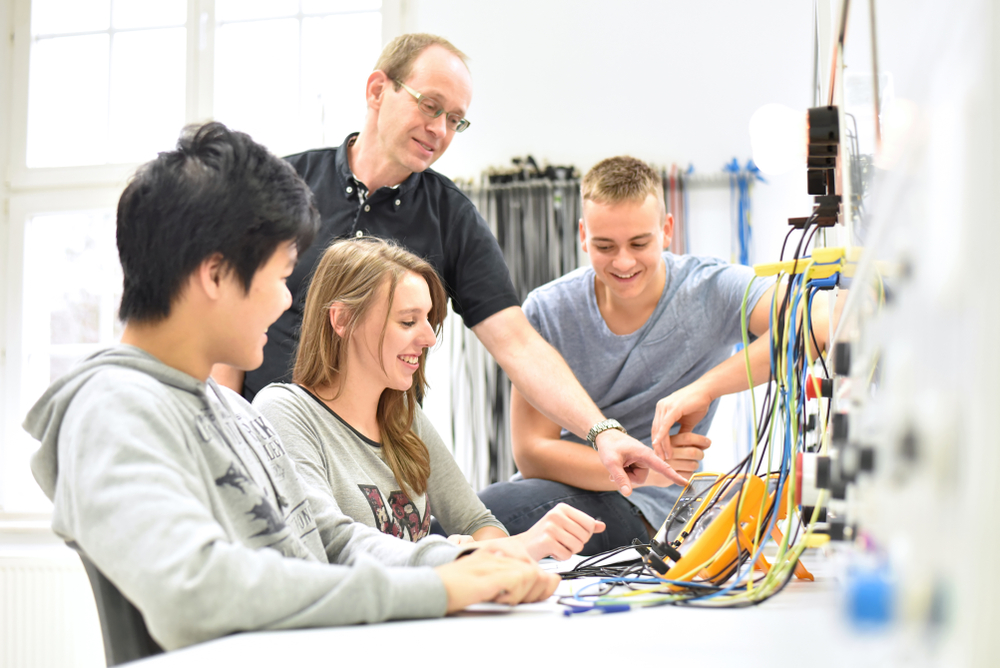

Hiring an Apprentice

Hiring an apprentice is an effective way to develop talent and improve a motivated and qualified team. Plus, it enables companies to upskill their workforce.

According to research, nearly 90 per cent of employees said apprenticeships helped them develop skills relevant to their organisation.

What exactly is an apprentice?

Apprentices are usually aged 16 or over and work in a specific role while combining studying to obtain the necessary knowledge and skills for that job. An apprenticeship role, therefore, counts as staying in full-time education.

New or current employees can be an apprentice but, you must pay them at least the minimum wage, which may differ depending on their age and the amount of time they serve under their apprenticeship. Additionally, the role must meet the following criteria:

- Allow apprentices to learn with specific skills for the job

- Receive time for studying or training during their working week (at least 20 per cent of their working hours)

- Work with experienced employees.

How do I hire an apprentice?

The first step in hiring an apprentice is to look into what type of apprenticeship you want for your business or organisation.

The second step is to search for what funding is available for the cost of training to your organisation.

Thirdly, find an organisation that offers training for the apprenticeship you have chosen.

Then, you can start to advertise the apprenticeship, which can be done through the national recruit an apprentice service.

Once you have selected your apprentice, you need to make an apprenticeship agreement and commitment statement.

However, if you do not want to hire and train the apprentice yourself, you can use an apprenticeship training agency, which will employ and train the apprentice when they are not working in your organisation.

Depending on which level the apprentice is at, apprenticeships can last anywhere between a year to five years.

HMRC letters remind businesses of VAT payments change

Reminder letters are being sent out to tens of thousands of UK companies explaining changes in the Making Tax Digital (MTD) system and how it affects them.

VAT: Cash vs Accrual Accounting

If your business is VAT-registered, or you are exploring the benefits of VAT registration, you must consider the different methods for accounting for VAT.

Social

Recent Posts

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

Categories

- Accountancy

- Accounting

- Apprentices

- Asset and Wealth Management

- Ben Allen

- Blog

- Blogs

- Bookkeeping

- Brexit

- Budget

- Business

- Business Advice

- Business Advice News

- Business Blog

- Business News

- Business Start-ups

- Capital Allowances

- Cash Flow

- Cash flow management

- Charities

- Corporate Tax

- Corporation Tax

- Covid-19 Home working and expenses

- Economy

- Employees

- Employment

- Employment and payroll

- Family Businesses

- Finance

- Financial News

- Financial Planning

- Fraud

- Funding

- Government Funding

- Grants

- Guide

- HMRC

- Home working and expenses

- Income Tax

- Inflation / Interest Rates

- Inheritance

- Investment

- Latest Business News

- Latest News

- Legal

- leisure and hospitality

- Loans

- Making Tax Digital

- Money

- MTD

- News

- PAYE

- Payroll

- Pension

- Pensions

- Personal Tax

- Personal taxes and finances

- Property

- Property News

- R&D

- Redundancy

- Scam

- Self Assessment

- Self Employed

- SME

- SMEs

- SMEs / Business

- Start ups

- Tax

- Tax Blog

- Tax News

- Tax Planning

- Tourism

- Uncategorized

- VAT

- VAT and MTD

- Wages

- Wealth Management